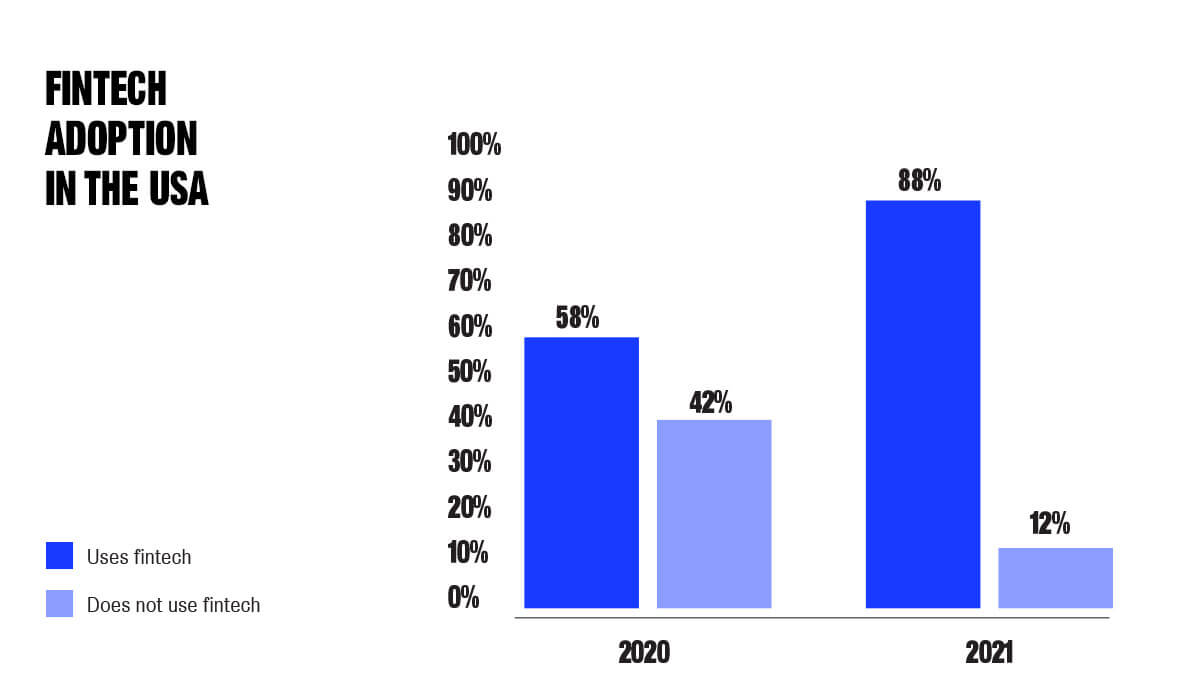

Find out why 88% of Americans were using Mobile Fintech products by 2021

With 58% of Americans saying they can’t live without tech to manage their finances, now is the time to understand how and why consumers are seeking a range of Mobile Fintech products.

In our new report, Fintech Trends USA 2022, we look into what American consumers are looking for from their finance products.

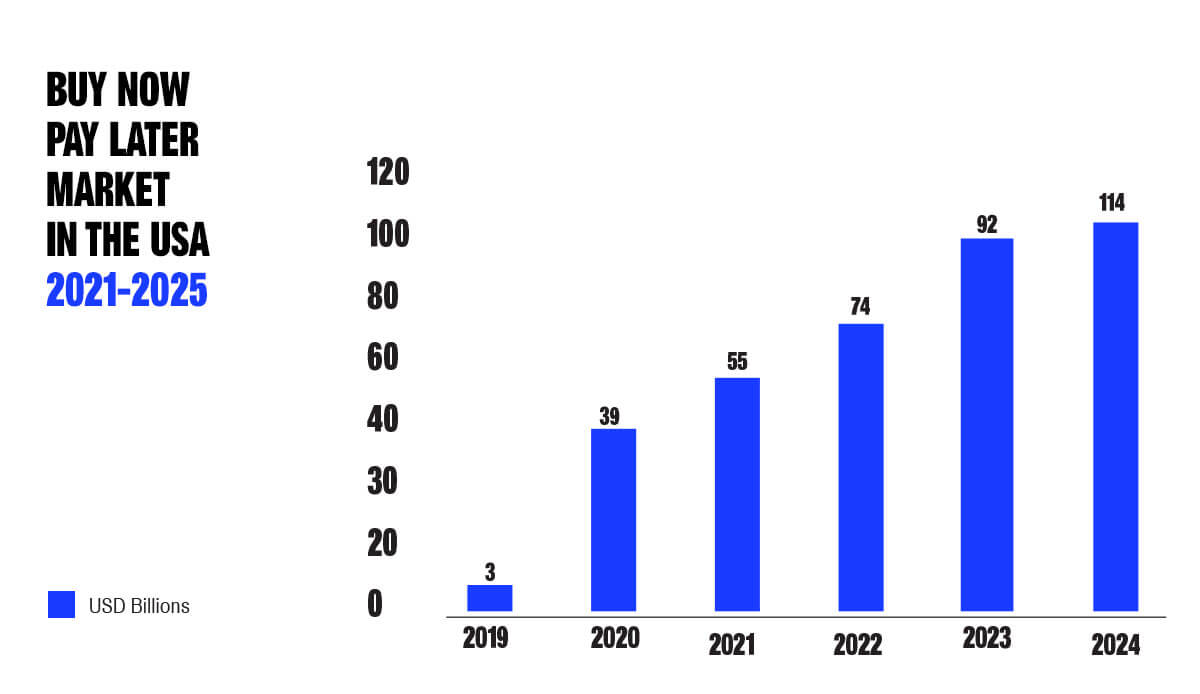

The report looks into sectors such as Neobanks, Crypto, Retail Investments, and Buy Now Pay Later services, all of which have seen huge adoption since 2019.

Take Buy Now Pay Later, which since 2020 saw +1200% growth in lending as people look to avoid credit card debt.

The report also looks at how to ensure performance creative will stand out with clear call to actions, messaging to ensure customers feel confident in the products, and which audiences are seeing the biggest growth in adoption.

You can also watch a recent recording of ‘How to craft a winning mobile fintech strategy’ where we covered elements of the Fintech Trends USA 2022 report on a panel with data.ai and LiftOff. You can watch this on-demand here.

Want to find out more?